This is going to be a big year for BigChange. The year we expand overseas. The year we double our turnover. The year acquisitions supercharge our growth.

Taking your business to the next level is never straightforward so I’m sharing my three scale-up strategies to help anyone on the same journey.

1. Strategic acquisitions

Many companies tend to wind down over the holiday season but here at BigChange, we had a busy end to the year. We have made our first acquisitions as a company, buying two complementary businesses that will help us double revenues year on year.

The first, Labyrinth Logistics Consulting, is an award-winning supply chain, logistics and compliance consultancy. We also acquired Trace Systems, a creator of fleet, garage and workshop management software, which will be integrated into the BigChange system to make our platform even richer.

These businesses will give BigChange a strategic edge and neither distracts from our core market. We’re still 100% focused on our platform, but these companies will help us deliver an even better service to our customers.

Acquisitions are a great way to scale faster with very little risk. These companies are both small – employing 10 people between them. That means that integration shouldn’t be too difficult.

I have quite a lot of experience acquiring companies now, which means I know how to manage professional fees a bit better without reducing the quality of the advice. Make sure you know when you need to use a lawyer and accountant and when you don’t. If you’re not careful, doing deals can get crazy expensive.

My other tip for acquisitions is to make sure you have a great right hand man. That meant that I wasn’t too distracted from the core business while the deals were being done, and also sped up the process. It took just three weeks from heads of terms being signed for the deals to be done.

2. Go international

We will open our first international office in Paris in February. We decided to create a European operations hub to both take advantage of the weak pound and mitigate Brexit risk.

We have recruited a French national to help expedite the European expansion. Our new VP for Europe, Frederic Dupeyron, will be our man on the ground. I’ve known him for over 10 years: he bought my previous company, Masternaut, so it’s a wonderful twist that he is now coming to work with me at BigChange. There is no substitute for hiring local talent when expanding overseas: they understand cultural differences and tend to be much better at troubleshooting.

France is just the beginning for us. From this launch pad, we will move into Benelux, Germany and the Netherlands. Later this year, we’ll move into the US and Asia. Australia comes next on the international roadmap. We don’t know what’s going to happen with the UK economy over the next few years so having an international outlook is a good way to hedge.

3. Get the basics right

I launched BigChange in 2013 and the company has grown organically since then, which has enabled us to build up our cash reserves. We’ve had to be patient to get to this point, where we can invest in new acquisitions and international growth. Scaling is expensive: we have invested in new acquisitions and a new international team. When you have cash in the bank, you can move quickly to take advantage of new opportunities.

In 2018, we turned over £11m, and – with these acquisitions – we’re on course to hit £23m in 2019 – more than doubling revenues. Profitability will also double, which proves that our growth model works.

It’s really important that we don’t take our eyes off the ball here in the UK as we grow overseas. That’s why we’re investing in more sales and customer service colleagues right here. BigChange will employ 150 people by the end of this year.

As we grow, we also need to make sure everyone is moving in the same direction. This is why I just had a huddle with the team to explain the deals we’ve done, and ensure that everyone understands the transformation plan for this year. It’s important that everyone keeps doing the basics right, and doesn’t get distracted.

These three pillars make up our 2019 scale-up plan. If executed properly, BigChange should be a much bigger company by this time next year. Wish us luck!

Martin Port

Founder & CEO

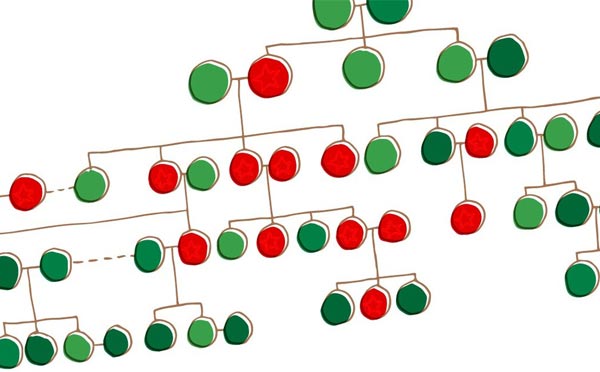

Israel is an extraordinary startup ecosystem. With a population of just 8.7m, the nation achieves twice the level of startup investment than any other country in the world. The unique Israeli Defence Forces (IDF) model means that conscripts are trained in all kinds of skills that help spur innovation. Professor Eugene Kandel, chief executive of Startup Nation Central, explained to me that IDF also has an unusual approach to military training. People are encouraged to question the status quo and make suggestions. No one salutes his or her superiors in the Israeli army, so it’s a hugely different culture. Crucially, soldiers are encouraged to develop their innovations once they leave the army, which helps explain why between 1,100 and 1,380 startups are established in Israel each year.

Israel is an extraordinary startup ecosystem. With a population of just 8.7m, the nation achieves twice the level of startup investment than any other country in the world. The unique Israeli Defence Forces (IDF) model means that conscripts are trained in all kinds of skills that help spur innovation. Professor Eugene Kandel, chief executive of Startup Nation Central, explained to me that IDF also has an unusual approach to military training. People are encouraged to question the status quo and make suggestions. No one salutes his or her superiors in the Israeli army, so it’s a hugely different culture. Crucially, soldiers are encouraged to develop their innovations once they leave the army, which helps explain why between 1,100 and 1,380 startups are established in Israel each year. Dr Yossi Bahagon is the man behind Qure Ventures, a venture capital vehicle that aims to back the start-ups that will revolutionise healthcare. He told me about one new company, which will help make virtual doctor’s appointments even more useful. It has invented a medical device that doubles as a stethoscope and thermometer. In future, you’ll be able to send your readings straight back to the doctor, over Skype, in real-time, to get a precise diagnosis. Imagine how much time and money that could save our NHS?

Dr Yossi Bahagon is the man behind Qure Ventures, a venture capital vehicle that aims to back the start-ups that will revolutionise healthcare. He told me about one new company, which will help make virtual doctor’s appointments even more useful. It has invented a medical device that doubles as a stethoscope and thermometer. In future, you’ll be able to send your readings straight back to the doctor, over Skype, in real-time, to get a precise diagnosis. Imagine how much time and money that could save our NHS? Then there was Ziv Aviram, whose hi-tech glasses are about to significantly improve the lives of the blind and visually impaired people across the world. The glasses can sense colour and describe the outside world to the user – they can even read a newspaper. Orcam Technologies is Aviram’s second venture; he sold his first, Mobileye, to Intel for $15.3bn.

Then there was Ziv Aviram, whose hi-tech glasses are about to significantly improve the lives of the blind and visually impaired people across the world. The glasses can sense colour and describe the outside world to the user – they can even read a newspaper. Orcam Technologies is Aviram’s second venture; he sold his first, Mobileye, to Intel for $15.3bn. Nothing saddens me more than the ongoing clashes between Israel and the Palestinian people, which is why I think the work of venture capital firm Sadara founded by an Israeli Jew and Arab Palestinian is so important to publicise. It’s a $30m fund that invests solely into Palestinian tech companies, helping to combat unemployment – in the West Bank & Gaza – and building links between the two. It has already made six investments and is backed by the likes of Google, George Soros and Cisco. This was an important reminder of the role business can play in international relations and helping to make the world a better place.

Nothing saddens me more than the ongoing clashes between Israel and the Palestinian people, which is why I think the work of venture capital firm Sadara founded by an Israeli Jew and Arab Palestinian is so important to publicise. It’s a $30m fund that invests solely into Palestinian tech companies, helping to combat unemployment – in the West Bank & Gaza – and building links between the two. It has already made six investments and is backed by the likes of Google, George Soros and Cisco. This was an important reminder of the role business can play in international relations and helping to make the world a better place.